WindoTraderBLUE & Market Activity

Ideas for Making 2020 Your Best Trading Year

In our quest to continually help our subscribers improve their trading, we asked them to tell us:

- The trading obstacle they most wanted to overcome in 2020

- What overcoming it would mean to them, and

- What prevented them from overcoming so far

Based on their responses, we took the 6 most common obstacles and developed this webinar to share concepts and ideas on ways to address and overcome them.

The topics for discussion were:

- Balance: Personal Life and Trading,

- Developing Performance Confidence,

- Gaining Performance Consistency,

- Addressing Fear,

- Trading and Trading Plans, and

- Trading Resources

Linda Raschke – Exceptional Performer

Three years ago, Linda Raschke, a true Exceptional Performer, joined us in a webinar and shared her observations regarding the markets, traders, and her beliefs on what it takes to become a consistently, profitable trader.

Today, she focuses on her own trading, and, on occasion, shares her observations with groups both nationally and internationally.

As someone who is always in motion, Linda recently finished her latest book, Trading Sardines. To get your copy of the book that truly shows you what it takes to be an exceptional performer, click on the following link.

TRADING SARDINES: Lessons in the Markets from a Lifelong Trader.

What I Know & What I’ve Done

How to Increase Your ROI Based on What You Know and What You’ve Done (Scorecard-02)

Truly knowing and understanding your present trading position or status gives you a tangible edge.

Our previous webinar, A Simple Process, introduced our four-part trader’s scorecard. The feedback we got ranged from ‘extremely helpful’ to ‘nothing new.’

In hindsight and based on the feedback, I fell short in not showing a contextual framework for the scorecard. I will fix that in this webinar by addressing the ‘whys’ for using scorecards and the many benefits of knowing what you know and what you’ve done.

For example, when you really know your strengths as a trader, you increase your ability to know where and how to apply them for the highest return.

And, when it comes to really knowing your weaknesses as a trader, you increase your ability to manage them and minimize their impact on your trading performance.

Takeaway: A model for capitalizing on what you know and what you’ve done

A Simple Process ‘For Taking Control’

A Simple Process (Scorecard-01)

“Start where you are. Use what you have. Do what you can –Arthur Ashe

Two years ago, prior to the Super Bowl, a reporter asked Tom Brady “What do you have to do to win today?”

He answered by saying, “We have to do the right plays (Knowing), at the right time (Thinking), the right way (Doing).”

Isn’t that also what a successful trader does over and over again?

Well, I believe it is:

- First, we must Know as much as we can about what is relevant and important as to the market(s) we trade and our unique style of performance.

- Second, we must Think holistically and use models and frameworks, independently and collectively, to raise-the-bar on our performance.

- Third, we must consistently Do all that we’re capable of doing and achieve all that we’re capable of achieving with what we currently have.

In this webinar, we will give you a model that will help you assess your current status as a trader regarding what you know, how you think, and what you do.

Takeaway: A model for self-assessing your know, think and do status.

Exceptional Performer, Tom Incorvia

Tom, a successful independent trader, began his trading career in 1987 at Lehman Brothers working with institutions and high net worth individuals.

With experience on both the buy and sell-side Tom brings a unique understanding of how market dynamics work. From the sell-side, he has managed equity trading desks and from the buy-side, founded and managed a successful hedge fund growing it to more than $400M AUM.

In 2007, having achieved his objectives in the corporate world, Tom became an independent trader. Experienced in Technical Analysis and Market Profile, he focused his trading on the short to intermediate term inefficiencies in the market.

Recently, Tom has started an equity trading research firm called Blue Tree Strategies, LLC, producing timely, actionable research for both the institutional as well as retail clients.

Today, Tom is what we call an ‘exceptional trader’ in that he truly transformed himself into a highly successful, independent trader.

Takeaway: One trader’s process for finding his ‘best-fit style and system’ as a trader

How to Systematize ‘Getting Better’

How to Systematize ‘Getting Better’

As traders, we continually strive to ‘get better’ but many times our actions do not match our intentions. Some of the reasons for the gap between intention and action include: limited time, overwhelm, what to study, where to start, distractions, and no plan or system.

Yet the bottom line is, assuming we really want to get better, we have no option but to learn and practice.

‘Systematizing’ is one proven way to learn and practice effectively and includes taking on a mindset to do so.

• Determine what you need to learn and practice and how to accomplish it.

• Find your support resources.

• Schedule your learning and practice sessions.

In this webinar, we will focus on how you can use systems, models, and schedules to your advantage. You can gain control of your learning and practice sessions to maximize benefits from your time, energy and money invested.

Takeaway: Proven models to gain the most from your learning and practice processes.

Trading Performance: ‘Earn the Right’

Trading Performance: ‘Earn the Right’

In school, you had to complete certain prerequisites to pass to the next grade.

In the service, you had to meet specific basic requirements to be promoted.

In sports, as a player, you had to qualify to play and keep your team position.

And, in almost every case, a third party made the decision whether you were qualified or not to advance.

For independent traders the rules are different, we subjectively decide when to go from A to B or in some cases from A to E and skip B, C, and D. From a 1 lot to a 2 lot or more. From a simulator to real money. To use an order execution system. To place a trade or not. Plus countless other decisions or actions.

Though these decisions and actions are not a matter of being right or wrong, in and of themselves, many times they are costly.

One simple way you can minimize these unwanted costs is by asking yourself, “Have I earned the right” to take the next step?”

Takeaway: How to develop an ‘earn the right’ process that helps you strengthen your trading performance.

3 Biggest Trading Mistakes, Paul and Terry

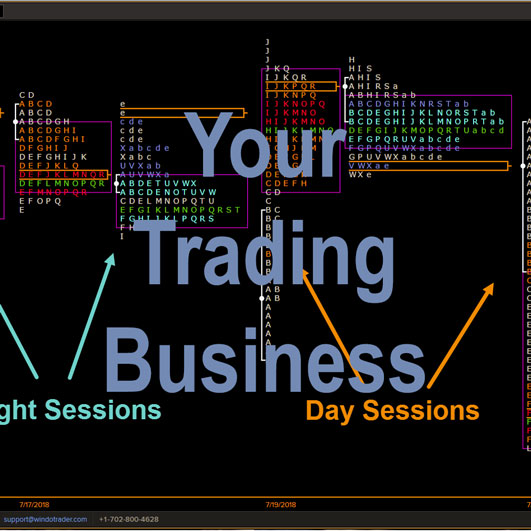

How to Correct 3 of the Biggest Trading Mistakes – Part 4 – Your Trading Structures

Trading Mistakes. In part 3 of this series on trading mistakes, we focus on the unlimited benefits of three of your eight ‘Core Trader Skills’, Thinking, Your Learning and Practicing, and Prioritization.

This webinar focuses on the power of two of the five primary elements of ‘Trading Structures’ including ideas on developing dynamic models that govern your trading performance:

Your Trading Process

Your Trading Methodology / Systems

“The way to build a complex system that works is to build it from very simple systems that work.”—Kevin Kelly

3 Biggest Trading Mistakes, Paul and Terry

How to Correct 3 of the Biggest Trading Mistakes – Part 3 – Core Trader Skills

Trading Mistakes. In part 2 of this series on trading mistakes, we focused on the power of and ways to clarify, clarify, confirm and capitalize on Your Trading Purpose and Your Core Trading Values.

This webinar focuses on the power of three of your eight ‘Core Trader Skills’ including how to personalize your management, improvement and ability to capitalize on each:

- Your Thinking Skills: Rational and Intuitive

- Your Learning and Practicing Skills

- Your Prioritization Skills

“Making good decisions is a crucial skill at every level.”

—Peter Drucker

3 Biggest Trading Mistakes, Paul and Terry

How to Correct 3 of the Biggest Trading Mistakes – Part-02 – Core Trading Principles

Trading Mistakes. In Part-01 of this series on trading mistakes, we shared our belief that most trading mistakes are symptoms of our failure to address our core trading principles, core trader skills, or trading operating structure.

This webinar focused on two of the five primary elements of ‘Core Trading Principles’ including how to clarify, confirm, and capitalize on each:

- Your Trading Purpose

- Your Trading Values

“Character is fate. The philosopher Heraclitus said that. I think what he meant is that man makes his destiny through his choices and his values.” -Walt Longmire

3 Biggest Trading Mistakes, Paul and Terry

How to Correct 3 of the Biggest Trading Mistakes – Part-01

Trading Mistakes. We all make errors and mistakes related to our trading. While learning from them is important, what we do with what we learned is critical to our development as a trader.

“How much you can learn when you fail determines how far you will go in achieving your goals” -Roy Bennett

Webinar Focus:

- Defining and classifying trading mistakes

- Understanding ‘why’ we make trading mistakes

- Proven ways to minimize and/or eliminate trading mistakes

Your Trading Beliefs, Paul and Terry

Your Trading Beliefs – Owned, Rented or Borrowed?

Trading Beliefs: Knowing Your Trading Beliefs. We all have trading beliefs, beliefs that have been acquired from an array of sources and resources. The positive: we learn things that help use trade better. The negative: many times we accept things as being true or right for us without challenging them.

Webinar Focus:

- How to validate a belief

- How to determine which beliefs are the ‘best fit’

- Ways to capitalize on your ‘best fit’ beliefs

Exceptional Performer, Michele Koenig

Michele has been a full-time trader since 2001. Her style includes both day and swing trades, with an emphasis on swing trading.

In 2012, Michele started sharing her trade ideas and setups on her blog as well as including some stories on rural life in Montana.

Michele graduated from Montana State University with a degree in Finance. She grew up in Montana and still lives there with her husband and many 4-legged kids. They enjoy fly-fishing, hunting, hiking, riding and skiing.

“One of the biggest rewards for me with the TradeontheFly community is helping other traders…..I love seeing the light bulb go off for new traders and get a lot of satisfaction from hearing that something I explained in a webinar or on my site has been added into a traders tool belt.”

The ExceptionalTrader Roadmap

After four years of dismal results, I was ready to quit trading. I had followed the belief that market knowledge and self-understanding were the only keys I needed to trade successfully.

Today, I still believe those two keys are critical to successful trading. However, I also believe that being a successful trader is about more than being successful in one’s trading.

The ExceptionalTrader Roadmap is not about successful trading. It is about one way many have become successful traders. Over four decades, I refined the Roadmap’s principles countless times while working with entrepreneurs and traders.

I offer it to help you to go further, faster in becoming the trader you aspire to be. ~Terry Liberman

Damon Pavlatos

Mastering the Art of Execution with Damon Pavlatos

If you are a trader striving to increase the net profit on your entries and reduce the net loss on each execution…then this webinar is for you wherein Damon will share several unique techniques.

Damon began his career in 1977 in the Futures Market. In 1986, he managed the S&P operations on the CME floor for Shearson-American Express and also executed for many of the top hedge fund and institutional traders. One of his clients, Paul Tudor Jones, said Damon’s execution skills, on behalf of the fund he was trading, saved him an average of one-half of an S&P tick per each execution. He calculated that Damon’s expert executions resulted in saving him over $1,000,000.00 for one year.

He is currently the CEO of FuturePath Trading and PhotonTrader Software. He is active in the Futures Market as an Exchange-member, trader, broker, and educator.

Robert Maurer, PhD

In this webinar presentation, Dr. Maurer, addresses seven types of support and what each type can mean to you and the members of your support team.

In addition, Dr. Maurer will share several principles, concepts, and benefits of a true-trading support team as a primary factor in achieving trading success.

Gregg Sciabica, Exceptional Performer

To introduce Gregg, we borrow Gregg’s interview in MOMO Traders (a must read book for traders) by Brady Dahl:

“Gregg began his trading career in 1998 and has been the #1 trader on Profit.ly for several years and has quickly grown to be one of the most well-respected traders on Twitter.

“As an extremely thoughtful trader, Gregg considers everything from the psychology of the other market participants to the ergonomics of his trading desk.

“Gregg believes in taking full advantage of trading opportunities and compounding profits which has served him well, resulting in profits of over $5 million in each of the last two years.”

In this webinar Gregg shares various lessons he’s learned over the past 18 years as a trader.

When he’s not trading he’ll usually be found taking time to enjoy the outdoor world of Arizona with his family or helping Traders4ACause advance its mission.

Linda Raschke, Exceptional Performer

As many of you know, Linda has been a full-time professional trader since 1981. Her performance was recognized by Jack Schwager in his book, New Market Wizards, and she went on to become a principal trader for several hedge funds. She retired from the hedge fund business in 2015 after 20+ years as a CTA.

Watch this special webinar to learn more about:

Linda and her experience as an independent trader and successful hedge fund trader. Find out about some of her personal trading strategies she will apply in her participation at the World Cup Advisor Program.

Seth Freudberg: SMB Options Trading

A Path to Becoming a Professional Options Trader

Characteristics of successful options traders

In this presentation, Seth shares:

- His experience as a trader and an educator on what he believes are the essential attributes of an exceptional performer in the trading arena.

- What distinguishes successful options traders from those who are struggling.

- Ideas for becoming more consistent and tackling the challenges that confront traders striving to succeed.

- An example of a simple options trade with an explanation of its dynamics.

Seth is a man who wears two hats:

First and foremost, Seth is a professional options trader.

Secondly, he is the Director of SMB Options Training Program wherein he oversees an options trading community (OptionsTribe.com) and teaches traders proprietary option strategies.

Jim Dalton: JDaltonTrading

On Wednesday, March 16th, 2016, ExceptionalTrader.com hosted a special Guest Webinar featuring Jim Dalton.

Jim gave this webinar on the brink of his retirement from active teaching. Make sure to discover more about Jim’s personal side. Learn how he got involved in trading, about some of his mentors along the way, the challenges he faced in becoming a trader and how he overcame them, his thoughts about HFT’s, Dark Pools on the industry, shorter term traders, how JDalton Trading evolved, and more …

Nate Michaud: Investors Underground

On Wednesday, January 20th, 2016, ExceptionalTrader.com hosted a special Guest Webinar featuring Nate Michaud, the founder of both the InvestorsUnderground and Traders4ACause.

To introduce Nate, we take an excerpt from MOMO Traders (a must read book for traders) by Brady Dahl.

“Nathan Michaud, is a momentum stock trader from New Hampshire. began trading in his late teens and progressed from nearly going broke after earning close to a million dollars his first year trading to becoming one of the most respected and prolific traders on Twitter.”

In this webinar Nate shared various lessons he’s learned as both a trader and a trading educator:

- Finding the style of trading that fits your personality.

- Risk and money management.

- The value of transparency and feedback.

- Professional vs amateur behavior.